Revolutionizing the Startup Back Office

Ksenia Golubeva

CBDO and co-founder of AutiHD, Luxembourg-based neurodiversity platform delivering AI-driven support for ADHD/autism in daily life and work.

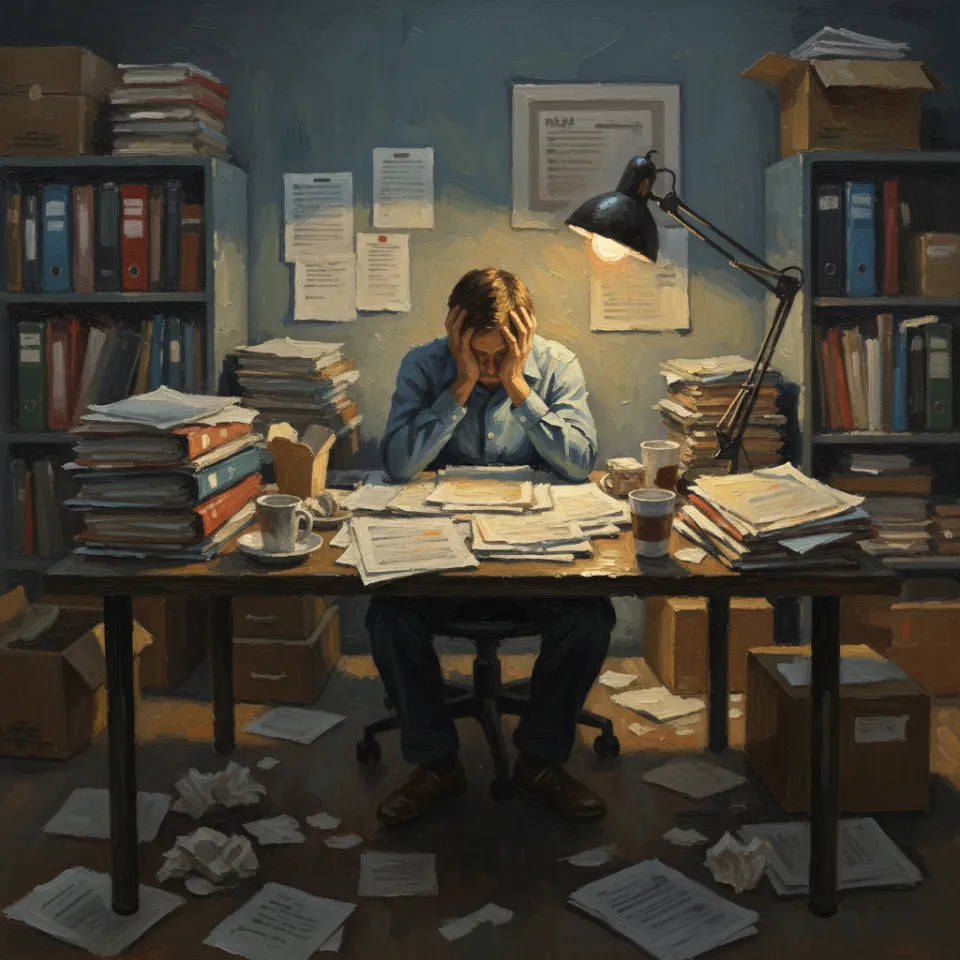

Some founders aren’t satisfied with fixing a problem—they want to erase it. Daniil Kirikov is one of those rare entrepreneurs who transforms personal frustration into streamlined solutions for entire industries. What pulled me to interview Daniil? Beyond his résumé, it's his infectious energy for founder-first innovation and his drive to take on problems most people flee—like bureaucratic labyrinths. We dig into how he’s untangling regulatory snarls for Luxembourg’s startups, how a five-minute demo closed a major client, and the mindset shifts that keep Daniil building, learning, and winning when others give in. At the heart of our conversation is his guiding belief: bureaucracy shouldn’t stifle ambition. Daniil’s mission? To free founders so they can get back to what matters—building.

As EasyBiz scales across Europe, what motivates you most about your work right now, and can you share a recent meaningful milestone or anecdote that captures your company's spirit?

Over your 12+ years shaping products and launching ventures, what were the biggest pain points or gaps you personally experienced that inspired EasyBiz’s creation?

Luxembourg is infamous for its bureaucratic hurdles in company formation. Can you walk us through some specific obstacles you encountered when starting your first business there, and how they helped crystallize the vision for EasyBiz?

How did your experience at 3F Venture Studio shape your approach to designing EasyBiz as a genuinely founder-first platform, not just an accountant’s tool?

Obtaining legal standing as a digital fiduciary wasn’t simple. Can you walk us through the licenses EasyBiz holds in Luxembourg, how long the approval process took, and a key regulatory hurdle you overcame along the way?

EasyBiz has earned a reputation for rapid onboarding—can you share a detailed story about a client’s unique problem, how you navigated their regulatory pain points using your platform, and what tangible results you helped them achieve?

For those curious about EasyBiz’s scale and business model—what does your team look like currently, can you share a revenue band, and how have you structured your pricing to serve both startups and larger SMEs?

Blending digital automation with localized compliance isn’t easy. How did you instill trust in regulators that AI wouldn’t erode the standards of fiduciary oversight?

Can you break down a specific end-to-end workflow at EasyBiz where your 'AI first, human where it matters' philosophy comes to life—what roles do automation and experts play, and how do you guarantee auditability and data security?

The regulatory environment—especially for fiduciary services—demands both speed and rigor. Can you share a specific crisis when you had to prioritize either delivery or compliance, what decision you made, and how it affected your team?

What are some pivotal wins—or failures—that most shaped your approach to leadership, automation, and blending innovation with day-to-day operational grit?

How will EasyBiz maintain its founder-first ethos as it scales into new markets like Belgium and France, each with its own compliance culture and regulatory ecosystem?

Share moment

Choose where you'd like to share this interview moment: